Table of Contents

Key Highlights

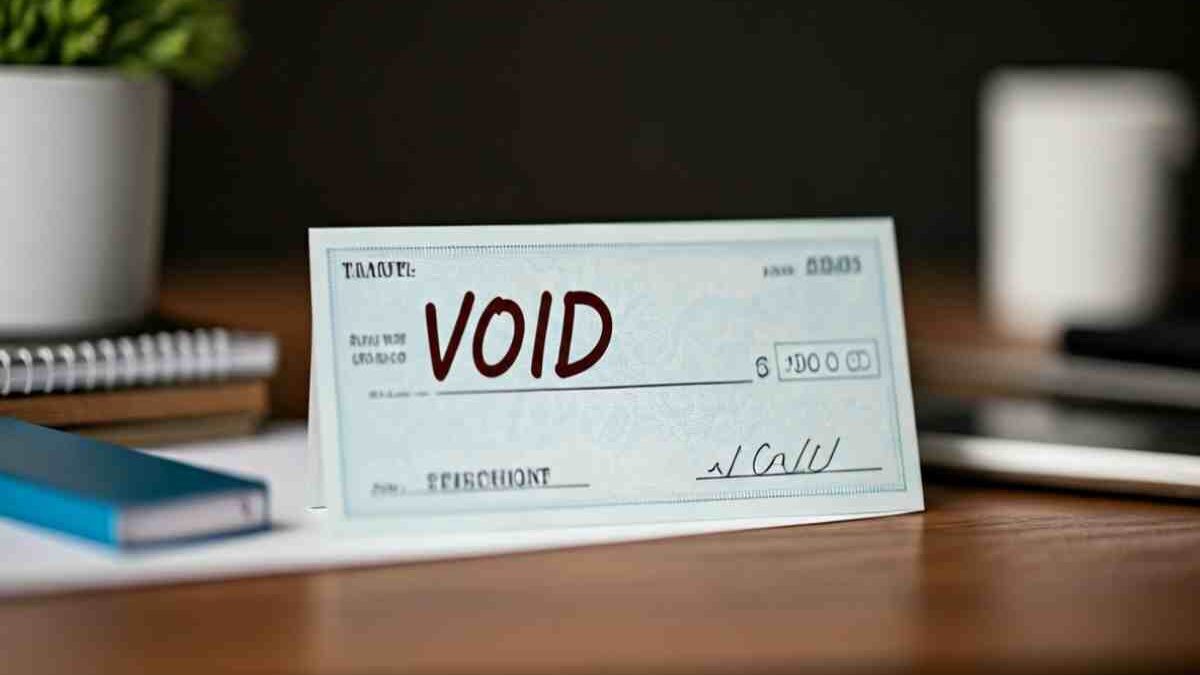

- A voided check has “VOID” written in large letters across the front, making it unusable for payments while still displaying your account information.

- Voided checks are commonly needed for setting up direct deposit, automatic payments, and verifying banking details.

- Using a check from your checkbook ensures your checking account and routing numbers are clearly shown for secure setup.

- Always use black or blue ink and never obscure critical information when voiding a check.

- Digital and online methods are available if you don’t have paper checks, including PDFs from online banking.

- Proper disposal of voided checks is essential to protect your bank account from identity theft.

Introduction

Even in today’s world of online banking, there are moments when you’ll need to know how to void a check. Whether you’re setting up direct deposit for your paycheck or sharing your bank account details safely, a voided check remains a trusted tool. Learning how to correctly void a check helps protect your account, ensures your direct deposit setup goes smoothly, and keeps your finances secure. This guide will walk you through every step and cover important situations where a voided check is needed.

Understanding Voided Checks

Voided checks, sometimes called “void cheques,” remain an important part of banking even with digital advancements. A voided check is a regular check from your checkbook that you purposely render unusable by writing “VOID” across it. Despite its invalid status, it still displays your banking information—such as your account and routing numbers—which is why it’s often requested for direct deposit or automatic payments.

You might wonder, why is a voided check necessary? Many employers, landlords, or payment services request one to ensure accurate account details for paychecks or monthly withdrawals. Situations like these make understanding voided checks a key part of managing your financial life.

What Does It Mean to Void a Check?

Voiding a check means you purposely make it unusable for payments by writing the word “VOID” across the blank check. This step ensures no one can fill in details and withdraw money from your account, while still displaying your account number and routing number for reference.

When voiding a check, you turn a regular paper check into a safe way to share your banking details. You should always write “VOID” in large letters with black or blue ink, making sure it runs across the front of the check. Avoid covering the check number or the numbers at the bottom, as these are needed for processing direct deposit or payments. You might need to void a check when setting up direct deposit with your employer, automatic bill payments, or electronic transfers, as organizations often require a voided check to confirm your account and routing numbers. Voiding a check ensures the check cannot be cashed and that your financial information is safely shared for these purposes.

If you’re unsure about the best approach, remember: never sign or fill in any other details when voiding a check. This keeps it clear for whoever receives it, like your employer or service provider, and prevents any confusion or misuse.

Common Situations When You Need to Void a Check

There are several everyday reasons why you might be asked to provide a voided check. Each has its own importance in securing your finances and ensuring correct account setup.

- Direct Deposit: Employers often require a voided check to accurately route your paycheck to your bank account.

- Automatic Payments: Companies may request a voided check to set up recurring payments, like a car loan or utility bill, using the correct account number.

- Account Verification: A landlord or financial service may need proof of your bank account details before they approve a lease or transfer.

- Correcting Mistakes: If you write the wrong amount or name on a check, voiding it ensures no accidental payments or confusion.

Understanding these scenarios will help you prepare and respond confidently the next time you’re asked for a voided check.

Step-by-Step Guide to Voiding a Physical Check

Voiding a physical check is a straightforward process, essential for both direct deposit and safeguarding your bank account. First, grab a check from your checkbook and make sure it’s blank. Using a pen with black or blue ink, clearly write “VOID” in large letters across the front. This action keeps your account information visible while preventing anyone from filling out or cashing the check.

Once voided, consider retaining a photocopy for your records. The next steps break down how to mark your check effectively and avoid common errors.

Properly Marking “VOID” Without Causing Issues

Marking “VOID” correctly ensures your voided check is accepted and secure. The right technique helps avoid confusion and prevents the check from being misused.

Start by writing “VOID” in large, clear letters, stretching across the check’s front. Use black ink for maximum visibility. Make sure the word runs through the payee line, amount box, and signature area. However, never cover your account number or routing number at the bottom—these need to stay visible for processing.

Key points for proper marking include:

- Choose a black or blue pen for clarity.

- Write in capital letters so the word “VOID” stands out.

- Avoid using pencil or colored ink.

- Don’t write over the critical numbers at the bottom.

This careful approach keeps your check secure and easy to process for direct deposits or payment setups.

Mistakes to Avoid When Voiding a Check

It’s simple to void a check, but a few common mistakes can jeopardize your account’s safety or create confusion in your records. Being alert to these missteps is key.

First, don’t write “VOID” too small or too lightly—this can leave your check vulnerable to fraudsters. Using a pencil is a big error, as the word could be erased. Never cover your account or routing number, since these details must be visible for any direct deposit setup.

Common mistakes include:

- Writing “VOID” in small or faint letters.

- Discarding a voided check without shredding it—identity theft is a real risk.

- Forgetting to record the voided check number in your checkbook.

- Accidentally signing or dating the check, which can cause confusion or misuse.

Always handle voided checks with care, and make sure to dispose of them securely.

Digital and Online Methods for Voiding a Check

If you don’t use paper checks, there are still ways to provide your banking information securely. Many banks offer digital checks or direct deposit info via online banking or accounting software. These methods allow you to download a PDF or print a digital check containing your account details, which can then be submitted for payroll or automatic payments.

It’s important to check with your employer or service provider to confirm if they accept electronic versions. The next sections cover how to use online banking tools and what to do if you lack paper checks.

Using Online Banking and Accounting Software

Online banking platforms and accounting software, like QuickBooks Online, make voiding checks and sharing account details convenient. Instead of sending a physical check, you can often create a PDF with your direct deposit info or generate a voided check electronically.

For example, QuickBooks Online allows you to void a check entry in your ledger, ensuring your accounting stays accurate. Many banks also let you print a document with your checking account and routing number for direct deposit or verification.

Here’s a comparison of features:

| Platform/Method | Void a Check Electronically? | Provides Account Info? | PDF Export Available? |

|---|---|---|---|

| QuickBooks Online | Yes, in ledger | Yes | Yes |

| Most Online Banking | Sometimes | Yes | Yes |

| Paper Checks | No, physical only | Yes | N/A |

These options are especially handy for small business owners or anyone who manages payments digitally.

Alternatives if You Don’t Have Paper Checks

You might not have a checkbook, but there are still alternatives to provide a voided check or account details. Several solutions are widely accepted by employers and service providers:

- Request a direct deposit form from your bank, which lists your bank account and routing number.

- Use an online banking portal to download a PDF or print a document showing your account information.

- Ask your bank or teller for an official letter or starter check that acts as a voided check.

- Sometimes, credit cards or account statements can also be used for verification if approved by the recipient.

These approaches make it possible to complete your setup without a paper check, keeping your finances accessible and secure even in a digital era.

Conclusion

In conclusion, understanding how to void a check is essential for anyone navigating financial transactions, whether in personal or business contexts. By following the outlined steps and considerations, you can ensure that your checks are properly voided, preventing any potential misuse. Remember that voiding a check not only protects your finances but also maintains clarity in your banking practices. If you have any lingering questions or need assistance, don’t hesitate to reach out for guidance. Start mastering your financial transactions today!

Frequently Asked Questions

Can I fix or reuse a check if I voided it by mistake?

Once you void a check by writing “VOID” across it, that check is no longer usable for payments or deposits. If you voided the wrong check, note the voided check number in your checkbook and consider issuing a stop payment if you’re concerned about its use.

Is it safe to send a voided check, and how can I protect my information?

Sending a voided check is generally safe, but always deliver it securely. Voided checks have your account information, so avoid sharing by email or leaving them in insecure places. Shred voided checks you don’t need to prevent identity theft or misuse by fraudsters or thieves.

How do I request a voided check from my bank if I don’t have checks?

If you lack paper checks, ask your bank for a document with your account and routing number—this can be a starter check or a printed invoice. Bank tellers can also provide a PDF or official letter that serves the purpose of a voided check for your account.